JEFFERSON CITY, Mo. — When lawmakers convene next year, a pivotal question will arise: to tax tips or not? This comes amid the Trump administration’s push for states to adopt a series of tax breaks intended for individuals and businesses.

The proposed tax breaks include deductions for tips and overtime wages, automobile loans, and business equipment, potentially yielding significant savings for residents. However, these savings often come at a cost to state budgets, which are already grappling with rising expenses in federal regulations.

In many states, tax laws differ, meaning that while some tax breaks automatically apply, others will require legislative approval. Workers receiving tips and overtime may find themselves in a complex situation, paying federal taxes on earnings while potentially still owing state taxes.

Recent analyses show that states conforming to Trump’s tax cuts could provide substantial savings, but they may also face financial strain. The urgency grows as states prepare for their fiscal years, with discussions heating up about whether to retroactively adjust tax codes before 2025 tax forms are filed.

Conformity and Challenges in State Tax Laws

Only a handful of states have indicated willingness to adopt these tax breaks thus far. Analysts reveal skepticism among states, as each weighs the long-term financial implications. Some Democratic-led states have been criticized for not aligning with federal tax cuts, while Republican-led states also appear divided.

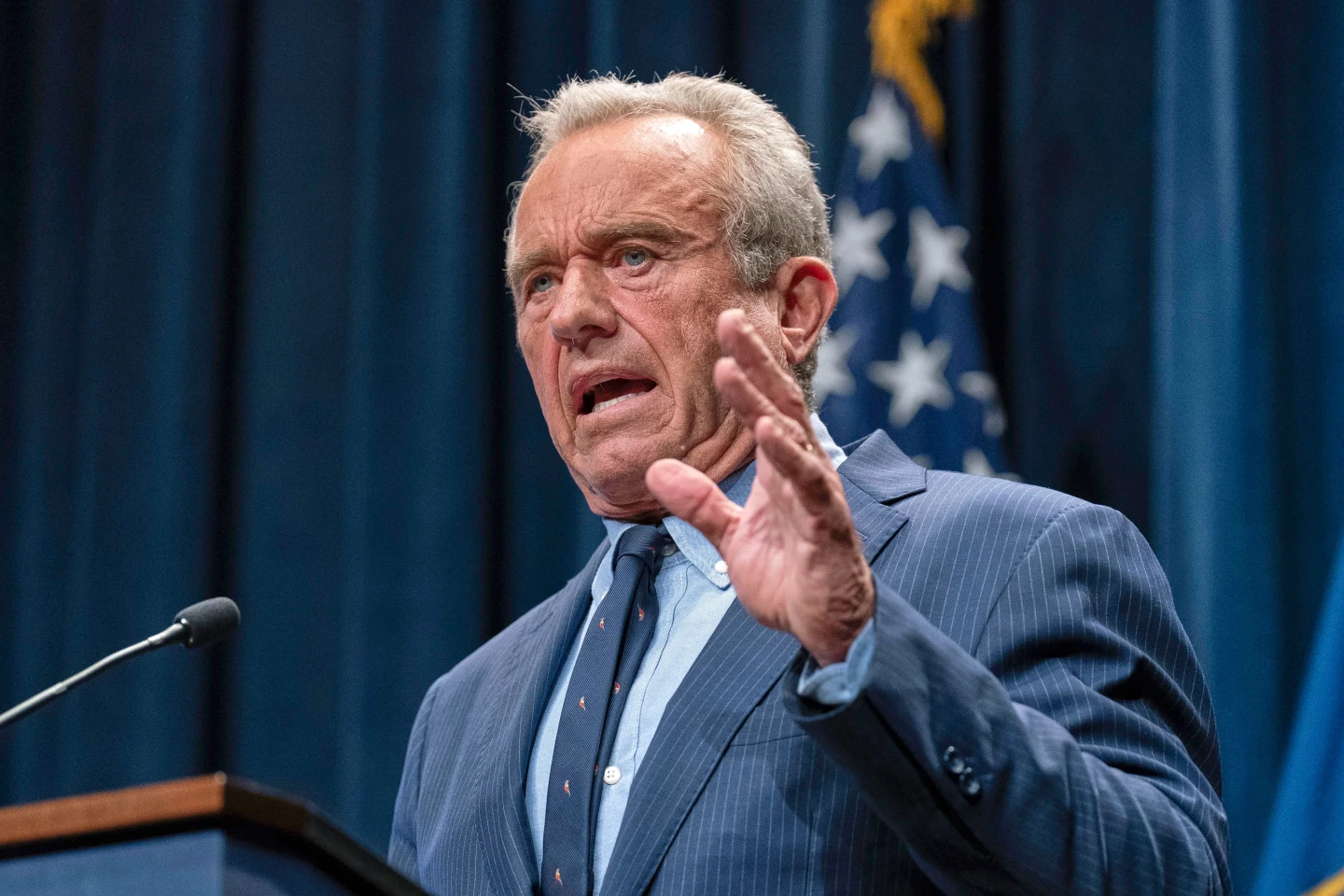

Treasury Secretary Scott Bessent has urged states to conform quickly, framing the debate as one of political choice versus populist relief for struggling families. Yet, tax analysts caution that these deductions may not serve all low-wage workers, raising questions about the inclusivity and fairness of the proposed changes.

With states like Michigan opting into certain breaks, and others considering positions, the debate continues. Arizona could be next to join the fray, as leadership there signals readiness to embrace the federal tax cuts when sessions commence. Meanwhile, states like Illinois and Delaware have actively blocked certain corporate tax breaks due to budgetary concerns.

The Road Ahead

The legislative landscape is rapidly evolving, with only a few weeks left before new sessions commence. Carl Davis from the Institute on Taxation and Economic Policy comments on the uncertain climate ahead. As states navigate these critical choices, the outcome will shape fiscal policy and economic relief efforts for years to come.